Direct Market Entry Dma Overview, The Way It Works, Users

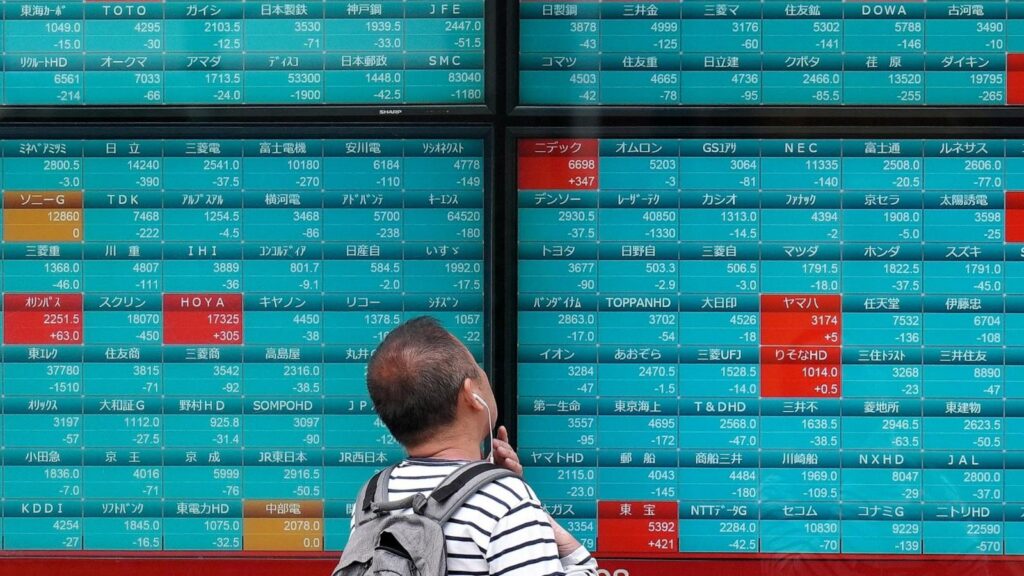

Equities, commodities, futures, overseas exchange and other tradable securities within the financial markets are bought and offered on an trade, which is often referred to as an organised market. Liquidity suppliers are entities that maintain a big amount of a monetary product. They present financing for the safety and then facilitate its buying and selling in the direct market. Since they ‘make the market’ for the safety, they’re subsequently also identified as market markers. Today, merchants can commerce securities by putting orders directly on the order books of inventory exchanges and electronic communication community brokers (ECNs) through direct market access (DMA trading). DMA empowers traders to become market makers somewhat than price takers.

This takes a couple of seconds and, if you cross the check, the order is placed immediately with an trade. So, if you would like to commerce Google shares via an internet buying and selling platform, you’d begin a buy order. You’d then set parameters in your commerce, such as the best price you wish to pay, the number of shares you need, and an expiry time for the order. The software will then scour the trade for a vendor and complete the order. Let us assume that a trader or a firm wants to commerce shares by way of direct market access.

Subscribe To Our Newsletter

Algorithmic trading helps to quicken the trading course of and obtain best execution for each place. This can also assist the trader to economize as automated trading techniques are usually more efficient and present less dangers. The meaning of direct market access with algorithmic buying and selling also helps to take advantage of order execution and quick transactions that traders might not have time to spot themselves. 69% of retail investor accounts lose money when spread betting and/or buying and selling CFDs with this supplier. You ought to contemplate whether or not you perceive how spread bets, CFDs, OTC options or any of our different products work and whether or not you’ll find a way to afford to take the high danger of dropping your cash.

Changes in supply and demand have an result on the market which means your moves are affecting the prices everybody else sees. We should add that, often, one of the best CFD brokers have the most effective status within the industry and tend to have professional or institutional clients. So, each time you’ve doubts or points regarding your trading expertise, all these brokers have the correct knowledge to help you in case you want it.

Are You Capable To Commerce Foreign Exchange Cfd Derivatives With A Direct Market Access Broker?

Before we talk about overseas change direct market entry, let us explain to you the foreign exchange oblique market entry. One of the main advantages of direct market access is the low latency it presents in comparison with the router layer that some brokers have. Some technology vendors attempt to optimize this feature calling their service as ultra-low latency direct market entry, implying they offer an improvement of their latency, compared to solely a low latency (LL) one. In order to avail the advantages of direct market access, the traders pay a minimal deposit for each dealer which is talked about above within the desk. Hence, the proprietor of direct market entry merely needs to pay an execution charge to send the trade order to the market.

Direct market access (DMA) differs from over-the-counter (OTC) in that DMA places trades instantly with an exchange while OTC happens exterior of exchanges and instantly between events. DMA presents more transparency, liquidity, regulation, and higher pricing. The know-how and infrastructure required to develop a direct market access buying and selling platform could be costly to build and preserve.

So you might guess that, from a cost-benefit perspective, high-frequency merchants are the ones who can doubtlessly profit from this ultra-low latency. DMA platforms are recognized for their speedy order execution, using fast algorithmic strategies to hold out common and block trades. They’re outfitted to place large volumes of trades with only one order.

Experience a more rewarding way to trade, with access to reduced spreads of as much as 28.6% through our tiered-volume payment low cost scheme. IG International Limited is licensed to conduct investment enterprise and digital asset business by the Bermuda Monetary Authority. All of this occurs in the background and may take just a few seconds. That’s one of many primary causes dma stands for in trading online buying and selling has turn into so accessible, inexpensive, and well-liked. Brokers, aka the middlemen, deal with the entire technical stuff and you get to purchase and promote by tapping a couple of buttons. You could have no proper to complain to the Financial Ombudsman Services or to seek compensation from the Financial Services Compensation Scheme.

Foreign Change Direct Market Entry

The order positioned by the provider in the direct market mirrors the price, volume and directions of the CFD. Google is listed on the NASDAQ trade beneath its father or mother company’s name, Alphabet Inc. As a dealer, you can use a DMA platform to purchase shares in Alphabet directly from NASDAQ.

They supply their direct market entry expertise and platforms to buy-side firms seeking to management the direct market access trading actions for his or her funding portfolios. If you want to purchase shares outright by way of DMA, you’ll search the L2 Dealer platform, the share dealing net platform or the cellular app for the best price that may be purchased. You would want to have the full amount of cash required to open the place in your account. As with buying and selling, your order will be positioned onto an exchange’s order books the place you’ll have the ability to see different exercise and analyse market sentiment. Contracts for distinction (CFDs) are derivative trades between a CFD supplier and a client. The dealer will base the value of a CFD on the price of the underlying financial instrument in the direct market.

Lit Vs Darkish Liquidity Swimming Pools

Exchanges the place shares, commodities, derivatives and different financial devices are traded include, the New York Stock Exchange (NYSE), the NASDAQ and the London Stock Exchange (LSE). Banks and different monetary institutions provide shoppers with direct market entry to digital amenities and order books of exchanges to facilitate and complete commerce orders. With the appearance of digital trading, direct market access has made the process of executing trades much more efficient for merchants as they will gain entry immediately with out having to rely on an intermediary. With direct market access, a dealer has full transparency of an exchange’s order book and all of its trade orders. Direct market entry platforms can be integrated with sophisticated algorithmic trading strategies that can streamline the buying and selling process for higher efficiency and price savings. The material (whether or not it states any opinions) is for general information purposes solely, and doesn’t keep in mind your personal circumstances or objectives.

Start trading with a live account orTry a demo with £10,000 of virtual funds. See our full product listing, entry trading point necessities and unfold reductions. Stay knowledgeable with global market information due to a free subscription on us when you sign up to CMC Alpha.

Understanding Direct Market Access (dma)

You should think about whether you perceive how this product works, and whether or not you’ll be able to afford to take the excessive threat of shedding your cash. We want to make clear that IG International does not have an official Line account right now. We haven’t established any official presence on Line messaging platform. Therefore, any accounts claiming to symbolize IG International on Line are unauthorized and should be thought of as pretend. Please make certain you perceive how this product works and whether or not you possibly can afford to take the high danger of losing cash. 65% of retail investor accounts lose money when trading CFDs with this supplier.

What Is Direct Market Entry (dma) In Trading?

Direct market access is recommended for superior traders solely, as there could additionally be difficulties. For instance, merchants achieve entry to superior buying and selling methods – corresponding to algorithmic buying and selling – which is more suitable for knowledgeable merchants. Advanced trading platforms and market gateways are essential to the apply of high-frequency buying and selling.